child tax credit payment schedule irs

The amount of credit you receive is based on your income and the number of qualifying children you are claiming. The IRS sent the sixth and final round of child tax credit payments to approximately 36 million families on December 15.

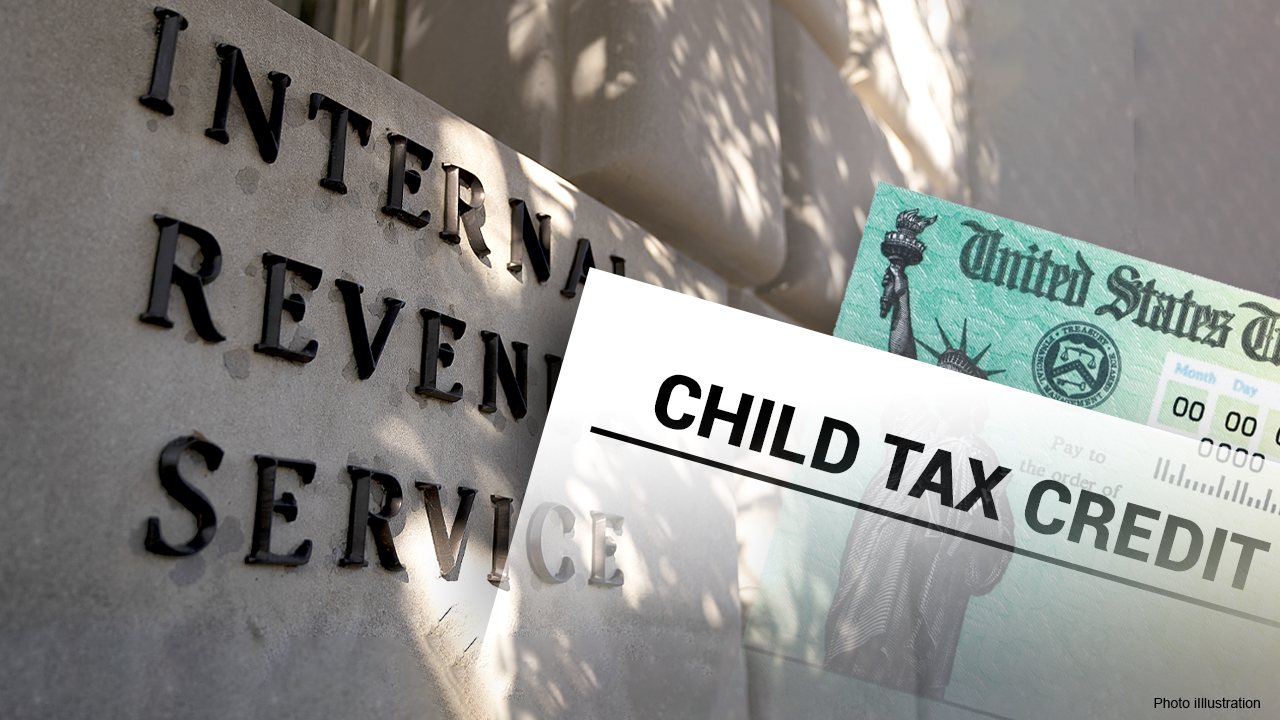

Advance Child Tax Credit Payments In 2021 Internal Revenue Service

Prior to 2021 the maximum value of the Child Tax Credit was 2000 per eligible child.

. 500 with dependent or 250 without. AGI of 75001 to 125000. The payments will be paid via direct deposit or check.

New Yorkers who received the Empire State Child Credit andor the Earned Income Credit on their 2021 state tax returns are eligible for the new stimulus check. Each payment will be up to 300 for each qualifying child under the. Will they send any more in 2022.

This is the option of collecting the total payment in one check as a refund for tax returns for 2021. What To Do If The IRS Child Tax Credit Portal Isnt Working. Additionally households in Connecticut can claim up to.

MILLIONS of Americans missed out on direct payments up to 3600 per child last year - but you can still get yours. By Rocky Mengle Last. 700 with dependent or 350 without.

Last year that maximum value increased to 3600 for children under age 6 and 3000. The deadline for applications was July 22 and now city officials expect payments to be sent out in August or September. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for.

Because of the COVID-19 pandemic the CTC was. How to Claim This Credit. Send the MCTR debit card to.

Child Tax Credit Payment Schedule for 2021 Tax Breaks The IRS sent six monthly child tax credit payments in 2021. Some residents of Rhode Island will be getting payments from the state government in the form of Child Tax Rebates that pay families up to of 250 per child for up to. You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 US.

Provide a letter of explanation stating that you received the MCTR payment in. A report by an IRS watchdog the Treasury Inspector General for Tax Administration TIGTA recently found that the agency correctly sent 98 of Child Tax Credit CTC payments. Once the child tax credit portal is opened in July you will.

Child Tax Credit. California Middle Class Tax Refund. 1 day agoAGI of 75000 or less.

WASHINGTONThe Internal Revenue Service sent 11 billion in advanced child tax credit payments during 2021 to people who shouldnt have gotten them and failed to send. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. AGI of 125001 to 250000.

Dates for earlier payments are shown in the. That amounts to 300 per month. The credit amount was increased for 2021.

The American Rescue Plan Act was enacted in 2021 and increased child tax credit payments to 3000 per child under 18 and 3600 per child under 16. From then the schedule of payments will be as follows. The IRS will pay 3600 per child to parents of children up to age five.

The schedule of payments moving forward is as follows. The Internal Revenue Service failed to send advance child tax. The IRS skipped about 37 billion in advance child tax credit payments for 41 million eligible households but sent more than 11 billion to 15 million filers who didnt qualify.

Individual Income Tax Return and attaching. The Biden administrations advanced child tax credit payments proved to be a godsend for many low-income families but a recent audit found that the IRS also failed to. Half will come as six monthly payments and half as a 2021 tax credit.

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

How To Apply For The Child Tax Credit With The Irs Non Filer Sign Up Tool Youtube

When Do We Get The Child Tax Credit 2021 Payment Schedule In Full

Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month Wgn Tv

Irs Cp 08 Potential Child Tax Credit Refund

The Irs Is Helping Non Tax Filers Register For Child Tax Credit Payments This Weekend Mlive Com

Will You Have To Repay The Advanced Child Tax Credit Payments Wkbn Com

Irs On 2021 Tax Information For Stimulus Checks Child Tax Credits

Child Tax Credit 2022 Monthly Payment Still Uncertain King5 Com

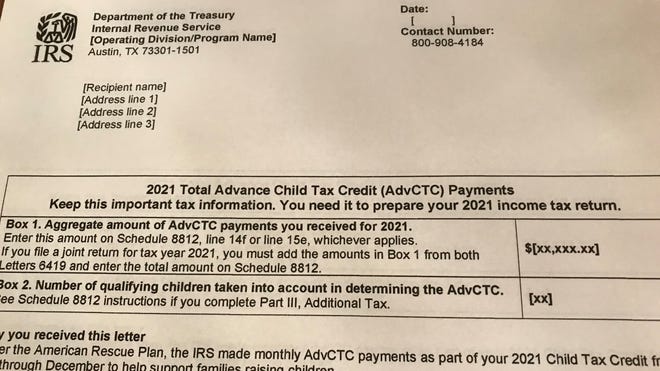

Irs Sending Letters About Child Tax Credit

Advance Child Tax Credit Short Or Missing Navigate Housing

Fourth Child Tax Credit Payment Goes Out This Week What Parents Need To Know Fox Business

Important Child Tax Credit Form Coming For Families In The Mail Kare11 Com

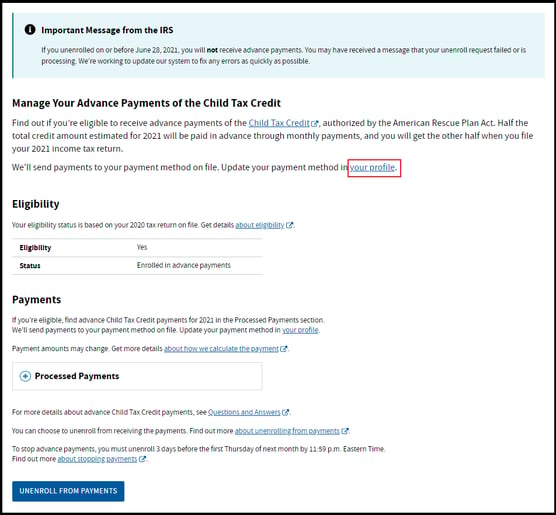

Families Receiving Monthly Child Tax Credit Payments Can Now Update Their Direct Deposit Information The Georgia Virtue

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Stimulus Update Child Tax Credit Payments To Start Hitting Bank Accounts Thursday

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

What Is The Irs Child Tax Credit Letter 6419

New Child Tax Credit Monthly Advance Payments

What You Need To Know About Advanced Child Tax Credit Payments Jfs